Losing a loved one can be overwhelming, but having a checklist ensures you handle legal, funeral, and emotional tasks with clarity, reducing stress during difficult times.

Understanding the Importance of a Checklist

A checklist is crucial when dealing with the death of a loved one, providing a structured approach to handle legal, emotional, and financial tasks efficiently. It ensures that no essential steps are overlooked, helping to alleviate stress during a difficult time. By organizing tasks into immediate, short-term, and long-term categories, a checklist offers clarity and guidance, making the process more manageable. It also serves as a valuable resource for family members and executors, ensuring that everything from funeral arrangements to estate settlements is addressed with care and precision.

Immediate Steps After Death

Ensure a legal pronouncement of death, secure the body, contact emergency services or a funeral home, and notify immediate family and authorities as required.

Obtaining a Legal Pronouncement of Death

A legal pronouncement of death is essential to confirm the passing officially. This step ensures the death is certified by a medical professional, such as a doctor, nurse practitioner, or coroner. The pronouncement is necessary for issuing a death certificate, which is required for legal and administrative processes. If the death occurs at home, particularly under hospice care, a nurse may provide the pronouncement. If the death is unexpected or suspicious, emergency services or a coroner must be involved. This formal step is crucial for proceeding with funeral arrangements and legal matters.

Contacting Emergency Services or a Funeral Home

Contacting emergency services or a funeral home is a critical first step after a death. If the death is unexpected, call 911 immediately to report the situation. For expected deaths, especially in hospice care, notify the funeral home directly. Funeral homes can assist with transporting the deceased and provide guidance on next steps. Be prepared to share basic information about the deceased and any prearranged funeral plans. If unsure, ask about their services and costs to ensure clarity. This step ensures the process is handled respectfully and efficiently, allowing you to focus on other important tasks.

Legal and Administrative Tasks

Secure the estate, notify authorities, and handle paperwork to ensure everything is legally sound and properly documented after a loved one passes away.

Registering the Death with the Appropriate Authorities

Registering the death is a legal requirement and must be done promptly. Contact the local register office where the death occurred to schedule an appointment. Provide necessary documents, such as a medical certificate, ID, and proof of address. The registrar will issue a death certificate, which is essential for funeral arrangements and legal processes. In some regions, you may also need to notify Social Security or other government agencies. Ensure all details are accurate to avoid delays. Once registered, obtain multiple copies of the death certificate for estate, financial, and legal matters. This step is crucial for finalizing the deceased’s affairs properly.

Obtaining a Death Certificate

A death certificate is a vital document required for funeral arrangements, estate matters, and legal processes. It is typically issued after the death is registered with the appropriate authorities. Contact the local registrar or vital records office to request copies. You may need multiple copies for handling financial accounts, insurance claims, and other administrative tasks. Ensure the certificate includes the deceased’s full name, date of death, and cause of death. Keep the originals safe and use certified copies for official purposes. This document is essential for finalizing the deceased’s affairs and ensuring all legal obligations are met.

Funeral and Memorial Arrangements

Arrange the funeral or memorial service, select a funeral home, plan the ceremony, notify family and friends, and prepare an obituary to honor the deceased properly.

Planning the Funeral or Memorial Service

Coordinate with a funeral home to discuss arrangements, choose a date and time, and select a venue. Decide on burial or cremation, and pick a casket or urn. Prepare an obituary with personal details, photos, and achievements. Plan the ceremony, including speeches, music, and readings. Consider cultural or religious traditions to honor the deceased. Ensure all legal documents are ready and notify attendees. Personalize the service with flowers, decorations, or special requests to reflect the individual’s life and legacy, providing comfort to grieving loved ones.

Notifying Family and Friends

Contact immediate family members and close friends to inform them of the passing. Be clear and compassionate in your communication. Provide essential details, such as the date and cause of death, if known. Offer support and answer any questions they may have. Consider delegating the task to trusted individuals to avoid repeating the news multiple times. Respect cultural or religious traditions when sharing the information; If appropriate, publish an obituary online or in a local newspaper to reach a wider audience. Ensure all notifications are handled with sensitivity and respect for the deceased and their loved ones.

Financial and Estate Matters

Secure the deceased’s belongings, notify banks, and close accounts. Consult an attorney or executor to manage the estate, ensuring all financial and legal obligations are addressed properly.

Securing the Deceased’s Belongings

Ensure the deceased’s home is secure to prevent theft or damage. Protect valuable items like jewelry, documents, and electronics. Inventory all assets for estate management. Safeguard digital assets, including passwords and financial information. Consider changing locks if necessary. Consider consulting with the executor or attorney to guide the process effectively.

Notifying Banks and Financial Institutions

Notify banks and financial institutions promptly to secure accounts and prevent unauthorized access. Provide the death certificate and will to initiate the process. Inform credit card companies to avoid fraudulent activity. Request account freezes and guide on next steps. Some banks may require specific documentation to proceed. Consider creating a checklist to track notifications and ensure all accounts are addressed. Seeking professional advice can help manage complex financial situations effectively.

Closing Accounts and Canceling Services

Closing accounts and canceling services is essential to prevent unauthorized access and unnecessary charges. Start by identifying all accounts, including credit cards, loans, and utilities. Contact each provider to request account closure, providing the death certificate and any required documentation. Cancel subscriptions, memberships, and recurring services to avoid further billing. This step helps protect the deceased’s financial identity and simplifies estate management. Keep a record of all cancellations for future reference. Addressing these tasks promptly ensures clarity and prevents potential complications.

Emotional and Practical Support

Seeking emotional support for loved ones is crucial during grief. Professional counseling or support groups can provide comfort, while practical help with daily tasks eases the burden.

Seeking Emotional Support for Loved Ones

Grieving can be isolating, so it’s essential to connect with others. Professional counseling or support groups offer a safe space to process emotions and share experiences. Family and friends can provide practical help, like managing daily tasks or organizing meals. Encourage open conversations to ensure everyone feels supported. Additionally, creating a checklist for ongoing tasks helps maintain organization and reduces overwhelm during this difficult time.

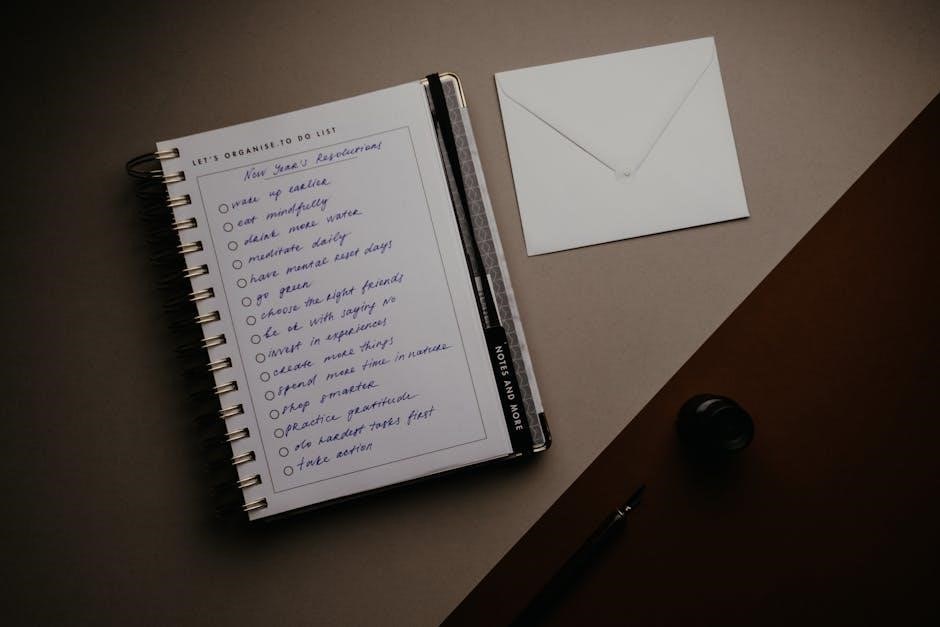

Creating a Checklist for Ongoing Tasks

A checklist for ongoing tasks helps manage the complexities of handling a loved one’s affairs after their passing. It should include legal steps, financial matters, and personal arrangements. Prioritize tasks like probate, estate settlement, and notifying institutions. Organize deadlines and responsibilities to ensure accountability. This tool provides clarity and reduces stress during a difficult time. Regularly review and update the checklist to track progress and address new needs. By staying organized, you can focus on healing while ensuring everything is handled thoughtfully and efficiently.

Long-Term Planning

Organize estate settlement, handle taxes, and distribute assets according to the will or legal requirements, ensuring all long-term financial and legal responsibilities are addressed properly.

Probate and Estate Settlement

Probate involves legally validating the deceased’s will and overseeing estate distribution. The executor, named in the will, manages this process, ensuring assets are identified, debts settled, and remaining assets distributed according to the will or legal requirements if no will exists. This step is crucial for finalizing the deceased’s financial affairs and transferring ownership of property, investments, and other belongings to beneficiaries. Proper documentation and legal guidance are essential to navigate this complex process efficiently and avoid potential disputes or legal issues.

Handling Taxes and Benefits

Filing the deceased’s final tax return and notifying relevant authorities is essential. Claim benefits, such as Social Security survivor benefits, if applicable. Ensure estate taxes are addressed, and update beneficiaries. Proper documentation and professional advice are crucial to navigate this process smoothly and avoid legal or financial issues. Handling taxes and benefits requires attention to detail to ensure compliance with legal requirements and maximize support for loved ones. Consulting a tax professional can help simplify this complex task and ensure all obligations are met efficiently.

A comprehensive checklist is invaluable for navigating the legal, financial, and emotional challenges after a loved one’s passing. It ensures organization and provides clear guidance for next steps.

Final Thoughts and Next Steps

Completing the checklist provides a sense of accomplishment and allows you to focus on healing. Review all tasks, ensure nothing is missed, and seek support if needed. Consider sharing the checklist with trusted family or friends to lighten the burden. Remember, taking care of yourself during this process is equally important. Once immediate steps are done, focus on long-term planning, such as estate settlement and financial adjustments. Lean on professionals for complex tasks and remember, it’s okay to ask for help.